Sanju Dangar

July 07, 2019

0

Facebook, Google, Apple App Ki Ak Kami Khojne Par 500$+ Inam Pane Ka Mauka

Bug Bounty Program के तहत मणिपुर के एक इंजीनियरिंग के स्टूडेंट ने फेसबुक को व्हाट्सप्प पे बग के बारे में जानकारी देकर 500$ का इनाम हासिल किया. फ्रेंड्स आज हम आपके लिए एक ऐसा आर्टिकल लेकर आये है जिसमे आप सोशल मीडिया एप्प की कमी ठूंठ के बहुत सारे प्राइस मनी जीत सकते है। तो हम बात करने वाले है कि आप किस सोशल मीडिया अप्प की कमी ठूंठ सकते है और कैसे कमी के बारे में किसको बताये इन सारी चीजों को के बारे में बताने वाले है तो पूरा आर्टिकल पढ़े। और ये भी जानेंगे की फेसबुक में बग खोजके कैसे बेस्ट अर्निंग की जाती है?➦ Social Media Ka Kare Positive Use, Hogi Lakho Me Side Income

फेसबुक में बग खोजके कैसे बेस्ट अर्निंग की जाती है?

Highlight; फेसबुक गूगल एप्पल एप्प की एक कमी निकलने पर ५००$+ इनाम पाने का मौका:

- 1- Facebook Ke Bug Bounty Program Ke Tahat Facebook Ne Bug Ki Jankari Di Thi.

- 2- Facebook Ki Ownership Wali Company Me Is Tarah Ka Program Chalaya Ja Raha Hai.

हम बात कर रहे है कुछ ही समय पहले की, फेसबुक ने मणिपुर के इंजीनियर स्टूडेंट को पुरस्कार के रूप में $500 (लगभग 35 हज़ार रुपये) दिए थे। एक इंजीनियर जोनल सोगेशम ने व्हाट्सएप में एक बग की खोज की। यह बग उपयोगकर्ता की गोपनीयता को नुकसान पहुंचाता था। इस बग को खोजने के लिए फेसबुक कंपनी ने जोनल को अवार्ड दिया। ज़ोनल ने व्हाट्सएप पर आने वाली समस्याओं के बारे में उनके एक दोस्त ने फोन करके बताया था, फीर ज़ोनल ने बग के बारे में खोज करने की शरुआत कि और सफलता भी हासिल की।

इस बग की वजह से, व्हाट्सएप्प में कॉलर की वॉयस कॉल वीडियो कॉल में अपग्रेड हो जाती थी, ये बात आपको भी पता होगी लेकिन हम ये सोचते थे कि ये फ़ीचर कंपनी ने ही यूज़र्स की फैसिलिटी के लिए दिया होगा। दरअसल जब हमे कोई भी यूजर व्हाट्सएप पे वौइस् कॉल करता था तब हम उनकी बिना परमिशन के वॉइस कॉल में से वीडियो कॉल में ट्रांसफर कर सकते थे, अब ऐसा नही होगा। जोनले मार्च महीने में इस बग के बारे में फेसबुक को जानकारी दी। 15 से 20 दिनों में, फेसबुक की तकनीकी टीम ने इस बग को हटा दिया। जोनल के नाम को 'हॉल ऑफ फेम' में भी शामिल किया गया था। फेसबुक ने 2014 में व्हाट्सएप का अनावरण किया। Apple में काम कर चुके टेक एक्सपर्ट सिद्धार्थ राजहंस ने इस बारे में कुछ स्पष्टीकरण दिया है कि कैसे कोई बग के बारे में जानकारी दे सकता है और पुरस्कार जीत सकता है। ➥Social Media Marketing Se Kare Income, Government De Rahi Hai Training

जोनले फेसबुक को कैसे दी जानकारी?

जोनले फेसबुक की बग बाउंटी प्रोग्राम के जरिये ये जानकारी कंपनी तक पहुचाई थी। कंपनी की आधिकारिक वेबसाइट www.facebook.com/whitehat द्वारा दी गई जानकारी के अनुसार, फेसबुक के बग बाउंटी प्रोग्राम के अनुसार, फेसबुक या उससे जुड़ी कंपनी में कोई खामी खोज ने पर कोई भी Users कंपनी को इस बारे में बता सकता है। यदि खामी उचित पाया जाता है, तो इसे हटा दिया जाएगा और खामी को खोजने वाले को इनाम दिया जाएगा। ➦2019 Me Internet Se Kamai Karne Ke Best 5 Ways

जानकारी प्रदान करने के तरीके के बारे में।

अगर आपको कोई कमी अप्प में दिख रही है और आप इस बारे में फेसबुक को बताना चाहते है तो आप सबसे पहले Https://www.facebook.com/whitehat/report/ पर जाए।

यहां आपको उत्पाद से संबंधित सभी विवरण प्रदान करने होंगे। विस्तारित जानकारी प्रदान करनी होगी। आवश्यक दस्तावेज संलग्न करें और सबमिट करदे।

बग काउंटी कार्यक्रम की शर्तें

आप जिस बग की खोज कर रहे हैं, वह कंपनी के पोलिसी के अनुसार होना चाहिए।

जिस प्रोग्राम और सर्विस बग बाउंटी प्रोग्राम स्कोप में लिस्टेड होगीे इससे संबंधित खामी होनी चाहिए।

- संभावित सुरक्षा मुद्दों ( सेक्युरिटी ईशू) की सूची अलग है, इसको बग बाउंटी प्रोग्राम में शामिल नहीं किया गया है।

- आप कंपनी के "Report a Security Vulnerability" पेज पर जा के https://www.facebook.com/whitehat/report/ पर रिपोर्ट सबमिट कर सकते हैं।

- कंपनी ने स्पष्ट रूप से लिखा है कि किसी भी फेसबुक कर्मचारी से कोई संपर्क नहीं होना चाहिए।

- यदि आपने गलती से कंपनी की गोपनीयता का उल्लंघन किया है, तो रिपोर्ट में वो भी बताए।

- इन्वेस्टिगेशन करते समय आप टेस्टिंग एकाउंट https://www.facebook.com/whitehat/accounts/ भी खोल सकते हैं।

फेसबुक किस तरह से जांच करती है।

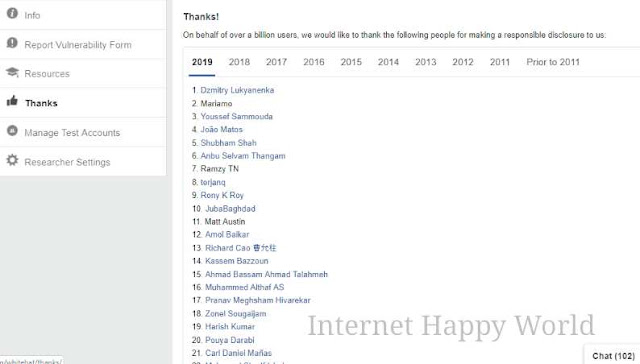

कंपनी सभी रिपोर्टों की जांच करती है। इसका मूल्यांकन इस आधार पर किया जाता है कि जोखिम कितना बड़ा है। इसमें अधिक समय लगता है। पुरस्कार राशि रिपोर्ट की गुणवत्ता, प्रदर्शन जैसे फ़ेक्टर को देखते हुए निर्धारित की जाती है। बाउंटी देने पर कम से कम $ 500 का इनाम दिया जाता हैं। डुप्लिकेट रिपोर्ट सबमिट करने से पहले, कंपनी उस व्यक्ति को खोजती है और फिर उसे पुरस्कार देती है। कंपनी ने उन सभी लोगों की एक लिस्ट बनाई है जिन्होंने 2011 से आज तक बग की खोज की है, आप ऊन्हे https://www.facebook.com/whitehat/thanks/ पेज पर देख सकते हो।

बग बाउंटी प्रोग्राम स्कोप

- Internet.org / free Basics

- Oculus

- Onavo

- Open Source Projects by facebook (e.g. osquery)

(कंपनी केवल इस सेवा पर ही बग बाउंटी कार्यक्रम प्रदान करती है, जो इसके स्वामित्व में आता है) Facebook, Google, Microsoft और Apple भी इस तरह के कार्यक्रम चलाते हैं

टेक कंपनी ऐप्पल में काम कर चुके तकनीकी विशेषज्ञ सिद्धार्थ राजहंस (यूएस) का कहना है कि Google, Microsoft और Apple भी फेसबुक के साथ इस तरह के डेवलपर रिवार्ड प्रोग्राम चलाते हैं। Google, Microsoft और Apple के लिए रेजिस्ट्रेशन करना आवश्यक है। बिना रेजिस्ट्रेशन के कोई बग की खोज नही कर सकता है। Google को एक साल में $ 25 और Apple में $ 39 का भुगतान करना होगा। जब फेसबुक रेजिस्ट्रेशन के लिए कोई शुल्क नहीं लेता है। फेसबुक में रेजिस्ट्रेशन के बिना, यह बग की खोज करके कंपनी को भेजा जा सकता है और अच्छी इनकम भी कर सकते है।

रेजिस्ट्रेशन के लिए कुछ लिंक:

- Apple के लिए https://developer.apple.com/ पर जाएं।

- Google के लिए https://developer.android.com/ पर जाएं।

- Microsoft के लिए https://developer.microsoft.com/en-us/ पर जाएं।

- Facebook के लिए https://Developers.facebook.com जाएं।

इस लड़के ने गूगल में ढूंढ निकाली एक बड़ी गलती, मिला $500 का इनाम।

दुनिया में सबसे ज्यादा इस्तेमाल होने वाले सर्च इंजन गूगल में गलती मिली तो गूगल ने भी इसे स्वीकार किया। ट्रांजिट कैंप निवासी 24 वर्षीय साइबर एक्सपर्ट सत्यम रस्तोगी ने सर्च इंजन गूगल में गलती निकालकर अपनी प्रतिभा का लोहा मनवाया है। गूगल की सिक्योरिटी टीम ने गलती निकालने पर उन्हें बतौर इनाम 500$ की प्रोत्साहन राशि दी है। ➥ Google Ke 8 Secret Features Ko Kaise Kare Use

सत्यम देहरादून की बेमको साइबर सिक्योरिटी में वेब एप्लीकेशन सिक्योरिटी रिसर्च और हैकर (सीनियर मैनेजर) के पद पर कार्यरत हैं। उनका दावा है कि 20 दिसंबर को गूगल की साइट पर उन्होंने फेमबिट (जिसमें गूगल के एड आते हैं) में CSRF नाम का बग (वायरस) ढूंढ निकाला। ➥ Famebit Se Sponsorship Le Ke, YouTube Channel Ki Earning Kaise Increase Kare

उन्होंने तुरंत गूगल के सिक्योरिटी टीम को बग मिलने संबंधी मेल भेजा। थोड़ी देर बाद ही गूगल ने भी गलती की पुष्टि की। गलती ढूंढने पर गूगल ने उन्हें 500 डॉलर प्रोत्साहन राशि देने का मेल किया। गूगल की सिक्योरिटी टीम ने सत्यम को वल्नेरेबिलिटी प्रोग्राम के तहत हॉल ऑफ फेम में 541वीं रैंक भी प्रदान की। ➥ Google Se Online Earning Karne Ke Sabse Aasan Tarika, 1 Survey/70Rs.

सत्यम ने बताया कि शिकागो (अमेरिका) में 2019 में गूगल की होने वाली वार्षिक कांफ्रेंस में उन्हें आमंत्रित किया गया है। सत्यम ने पिछले साल एप्पल और माइक्रोसॉफ्ट कंपनी की वेबसाइट में भी बग ढूंढे थे। तब भी उन्हें काफी प्रोत्साहन मिला था।

सत्यम ने बताया कि उन्होंने इजराइल के OSP (Offensive Security Certified Professional) कोर्स की ऑनलाइन पढ़ाई की। यह कोर्स भारत में बहुत कम लोग ही कर पाते हैं। उनकी माता बबली रस्तोगी ब्यूटी पार्लर चलाती हैं, जबकि पिता राम अवतार का साल 2014 में गंभीर बीमारी के चलते निधन हो गया था।

Ye Bhi Padhe➥

Ye Bhi Padhe➥

- Internet Se Earning Karne Ke Sabse Best And Easy Ways - 4 Tips

- Facebook For Creator App Ke Jariye Kaise Kama Sakte Hai Paise

- Instagram Se Kaise Kare Kamai, Yearly Earning 6 Lakh Up

- Ethical Hacking (Cyber Security Researcher) Ke Scope Kya Hai India Me.

- Aadhar Card Ki Security Kaise Rakhe 10 Most Important Tips

- Hacking Ko Apna Career Kaise Banaye, Top 5 Legally Website Se Free Me.

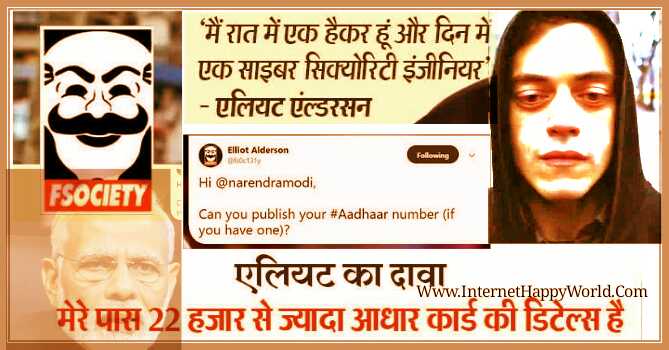

- Aadhaar Data Leak Karne Wala Ethical Hacker Elliot Alderson Kon Hai.

I Hope Aapko Bug Bounty Program se Related kaphi Saari jankari mili hogi Agar Aapko hamari yeh Article Better laga hai to Aap Isse Share karke Hamara Sahyog kare . Thank for visit !!!!