Sanju Dangar

July 10, 2019

0

नए आधार कार्ड के लिए आवेदन कैसे करे। री-प्रिंट ऑप्शन क्या है?

अगर आपने नए आधार कार्ड के लिए आवेदन किया है, लेकिन आधार कार्ड डाक से प्राप्त नहीं हुआ है या कहीं खो गया है, तो Unique Identification Authority of India (UIDAI) ने ऐसे लोगों के लिए ऑर्डर आधार री-प्रिंट की सुविधा प्रदान की है। इस सुविधा के तहत, आपको सामान्य पोस्ट से नहीं, बल्कि स्पीड पोस्ट से आधार कॉपी मिलेगी। इससे अब आधार कार्ड खोने की समस्या नहीं होगी।

ऑर्डर री-प्रिंट कैसे करें?

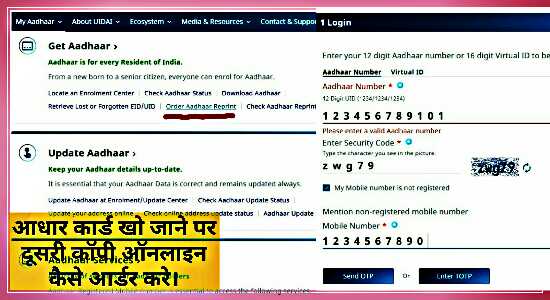

- सबसे पहले https://www.uidai.gov.in/ वेबसाइट पर जाएं।

- यहां Order Aadhaar Reprint विकल्प पर क्लिक करें।

- फिर अपना 12 अंकों का आधार कार्ड नंबर या 16 अंकों का वर्चुअल आइडेंटिफिकेशन नंबर डालें। फिर सिक्योरिटी कोड भरें।

- यदि आपके पास एक रजिस्टर्ड मोबाइल नंबर नहीं है, तो नीचे दिए गए बॉक्स पर क्लिक करें और आपके पास मौजूद नंबर दर्ज करें।

- फिर सेंड ओटीपी पर क्लिक करें और अपने मोबाइल पर एक ओटीपी सबमिट करके वेरिफिकेशन प्रक्रिया को पूरा करें।

अब आप चाहे तो एक बार अपने आधार कार्ड का फाइनल प्रीव्यू भी देख सकते हैं।फाइनल प्रीव्यू के बाद, मैक पैमेंट विकल्प पर क्लिक करके आधार रीप्रिंट शुल्क जमा करें।

भुगतान के बाद रसीद जनरेट होगी, जिसे आप पीडीएफ फॉर्मेट में डाउनलोड कर सकते हैं। इसके साथ आपको एसएमएस के जरिए एक सर्विस रिक्वेस्ट नंबर (SRN) भी मिलेगा। आपको 5 से 7 दिनों के भीतर अपना आधार कार्ड मिल जाएगा। हालाँकि, यदि आप चाहें, तो आप अपने एसआरएन नंबर के जरिए आधार कार्ड की डिलीवरी को ट्रैक कर सकते हैं।

आधार के री-प्रिंट का आदेश देने के बाद, आपको स्पीड पोस्ट से आधार कार्ड की कॉपी मिल जाएगी, लेकिन आपको इसके लिए अतिरिक्त शुल्क देना होगा। स्पीड पोस्ट से आधार कार्ड लेने के लिए आपको अलग से 50 रुपये देने होंगे।

UIDAI के कॉमन सर्विस सेंटर।

UIDAI ने फिर एक बार देश भर में फैले कॉमन सर्विस सेंटरों के माध्यम से अपनी सेवाओं को शुरू करने का फैसला किया है। इस कॉमन सर्विस सेंटर पर आधार कार्ड अपडेट किया जा सकता है। और गलती को भी ठीक कर सकता है। वर्तमान में देश में लगभग 3.9 लाख कॉमन सर्विस सेंटर हैं।

Ye Bhi Padhe➥

Ye Bhi Padhe➥

- Aadhaar Data Leak Hone Se Kaise Bache, Aise Hi 10 Sawalo Ke Jawab.

- Aadhaar Card Se Hone Wale 8 Fayde Kya Hai.

- Aadhaar Card Ko, Pan Card Se Aise Kare Link - Online Easy Process

- Ethical Hacking (Cyber Security Researcher) Ke Scope Kya Hai India Me.

- Aadhaar Card (UIDAI) Me Nikali Hai Jobs, Kaise Kare Online Apply.

- Aadhar Card Ki Security Kaise Rakhe 10 Most Important Tips

- Bina Address Proof Ke Aadhar Address Ko Update Kaise Kare.

- Phone Number Ko Aadhar Se Link Karne Ki Sabse Aasan Process

- Aadhaar Data Leak Karne Wala Ethical Hacker Elliot Alderson Kon Hai.

- Children Aadhar Card Kaise Banaye, Aur Biometric Update Karne Ki Aasan Process